Happy New Year! We hope you were able to spend time with those who you care about most over the holiday season.

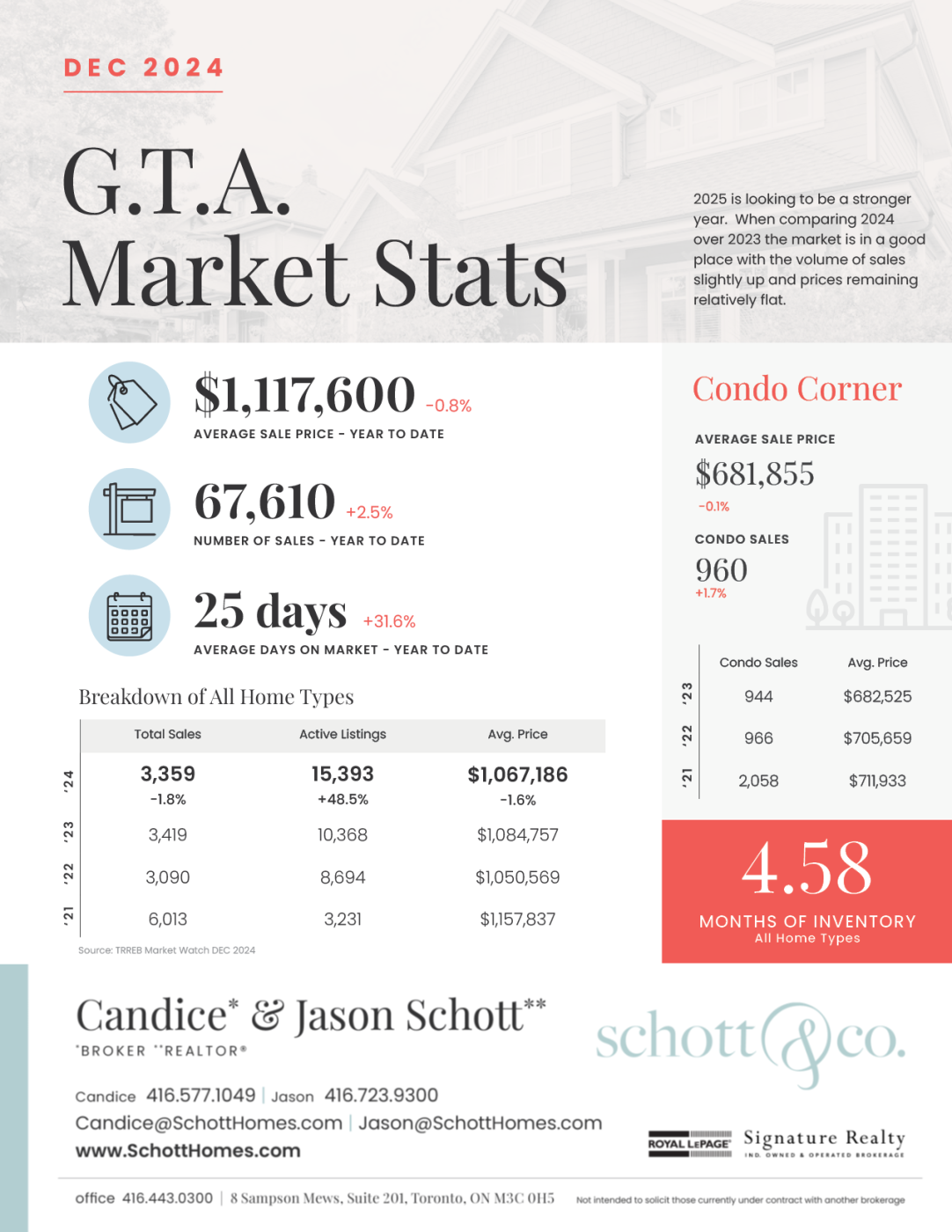

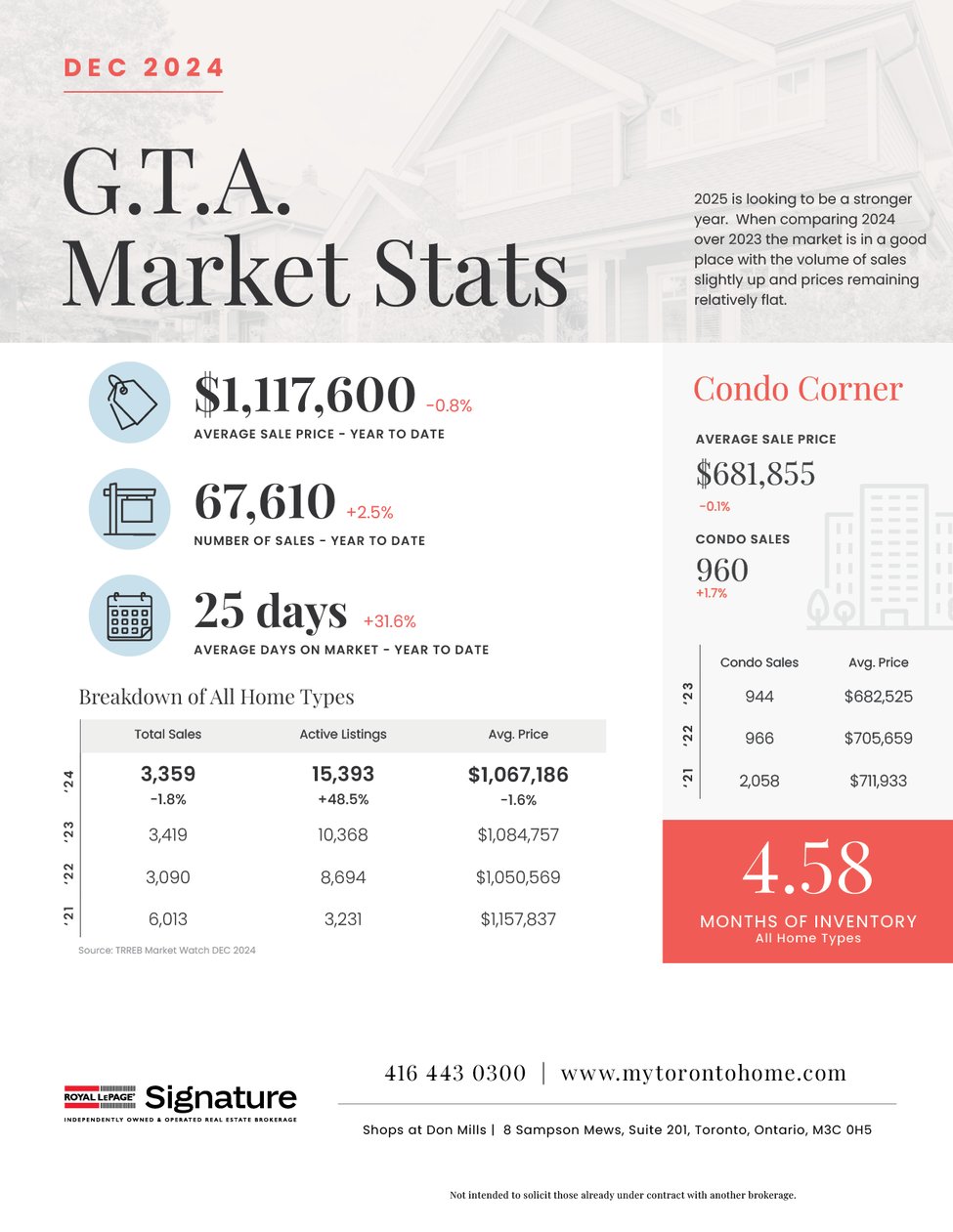

As we look back on 2024, early on the residential real estate market initially struggled to gain a footing under the pressure of high interest rates. Higher interest rates presented significant affordability hurdles for home buyers that kept sales well below what is considered normal levels. The first interest rate reduction did not happen until June and since then, with the Canadian economy retracting toward a recession, the Bank of Canada acted quickly. They have now dropped rates from their high of 5% to 3.25% with 5 quick moves including two moves of 50 basis points. The real estate market showed its first signs of responding to the rate moves in October. We witnessed a 44% increase in transaction volume followed by a 40% increase in November. Further rate cuts in 2025 and home prices remaining below their historic highs will result in improved market conditions over the next 12 months. The year ended with sales volume up 2.5% and prices flat over 2023.

Annual 2024 home sales amounted to 67,610. There was more choice for buyers throughout the year as inventory levels of available homes for sale grew. The year ended in what can be considered a buyer’s market, with just over 4.5 months of supply of homes for sale of all types, which continues to keep a ceiling on any widespread price growth. The average selling price for all home types was $1,117,600 in 2024, representing a decline of less than one per cent compared to the 2023 average of $1,126,263. Market conditions were stronger for detached, semis and town-home housing with selling prices holding up better in these segments, price declines were more notable for condo apartments. The Chief Market Analyst for the Toronto Regional Real Estate Board, Jason Mercer, reiterated this by stating that market conditions varied by market segment in 2024. Many would-be first-time buyers remained on the sidelines, anticipating more interest rate relief in 2025. The lack of first-time buyers impacted the less-expensive condo segment more so than the single-family segments. Sales of single-family homes, including detached houses, increased last year, whereas condo apartment sales were down.

As we anticipate further interest rate reductions in the coming months, the real estate market enters 2025 with renewed optimism as we predict greater sales volume and price growth throughout most home types. The condominium market will continue to face headwinds this year as there will be a record number of newly completed condo units delivered with many to be put up for sale or lease. However, there will be pockets of strength in certain condo types and locations.

We wish you all the very best in 2025. When considering your real estate plans this year, know that we are only a call or text away, we would welcome the opportunity to discuss market conditions and strategies that would best suit your needs.

PS - We would be happy to provide you with micro data on your specific area anytime! We are just a text message away.