The Spring Market has been steady, and the Bank of Canada has finally dropped rates as we hoped! The BOC’s recent statement is clear: they are pleased with the current inflation levels and plan to continue lowering rates. Inflation results for May might put a hold on the July rate decrease however we do expect to see a steady decline moving forward, albeit slow, but a decline nonetheless. So for those of you in a variable rate mortgage product just like us, we welcome this decline, even if it's only a little at a time :)

This market has demonstrated the resilience of GTA real estate and highlighted the critical role of borrowing costs. As June 5th approached, it felt like the entire country was on edge awaiting the BOC's decision. This rate cut, the first in four years, marks the beginning of a new cycle of lower interest rates. Governor Tiff Macklem emphasized their satisfaction with the inflation outlook and the expectation of further rate reductions.

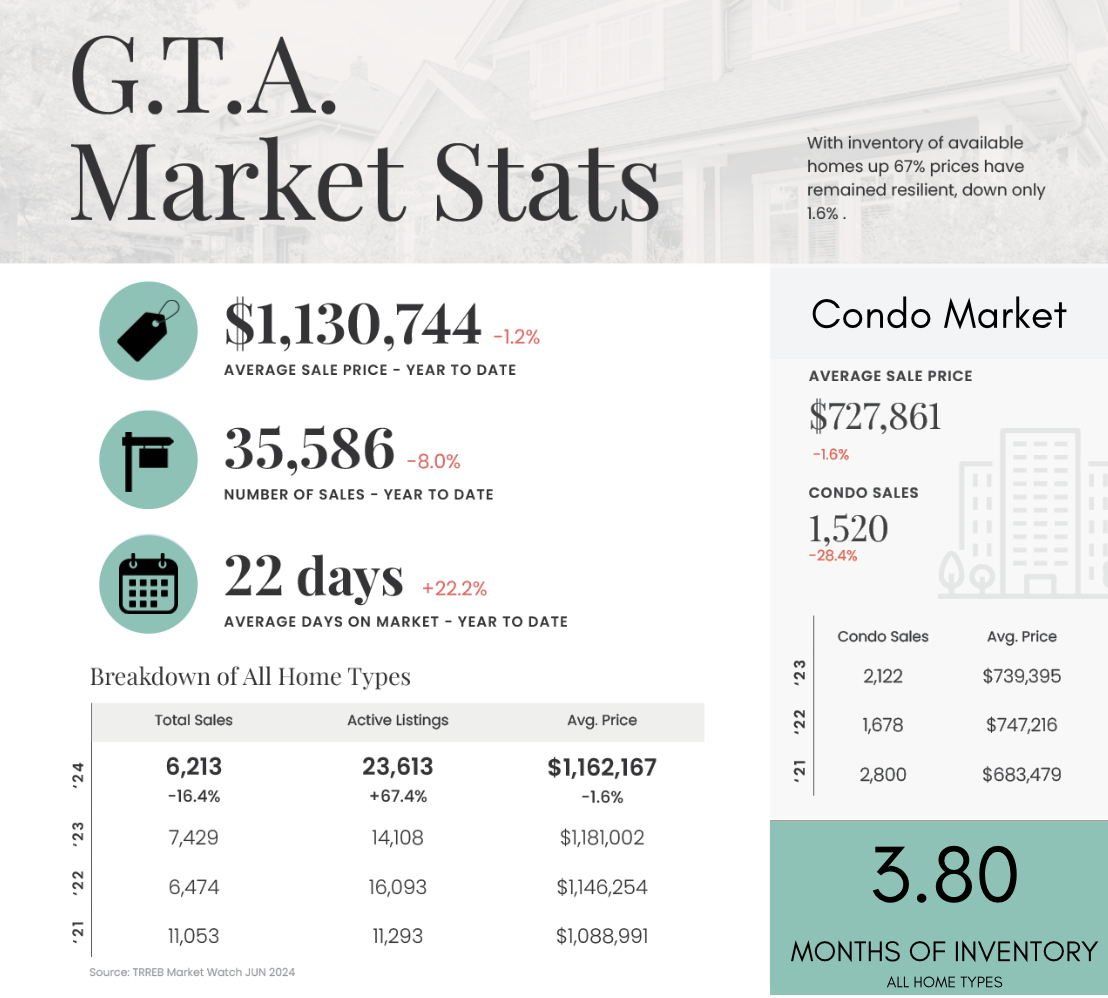

The last 24 months have been challenging. As the BOC quickly raised rates to combat inflation, the real estate market responded accordingly, with transaction volumes dropping by 50%. This strategy was designed to create a restrictive monetary policy to eliminate inflation, though it took longer than expected. After a period of artificially low rates that pushed real estate prices to record highs, we are now entering a period of stability and sustainable growth.

If we could set aside the brief peak from November 2021 to March 2022, we’d be very satisfied with today’s average sale price. Studying the history of real estate values helps us understand market conditions more clearly. Real estate has always been a long-term asset.

As we enter the second half of 2024, we are confident further rate cuts by the BOC this year will likely boost market confidence and activity. We hope a slow and steady approach to rate adjustments will foster healthy and sustainable growth. If rates continue to decline and our population grows, transaction volumes and prices are sure to increase.

For now, we will focus on analyzing data, working with facts, and helping you, our clients make high-quality decisions. We’re looking forward to the July 24th BOC rate announcement and are prepared to grow with the market, guiding our clients to success in the second half of 2024.