Toronto Real Estate Market Update: January 2026 (AKA: The Market Also Doesn’t Want to Go Outside)

If you’ve looked out the window lately and thought, “Cool, so winter chose violence,” you’re not alone.

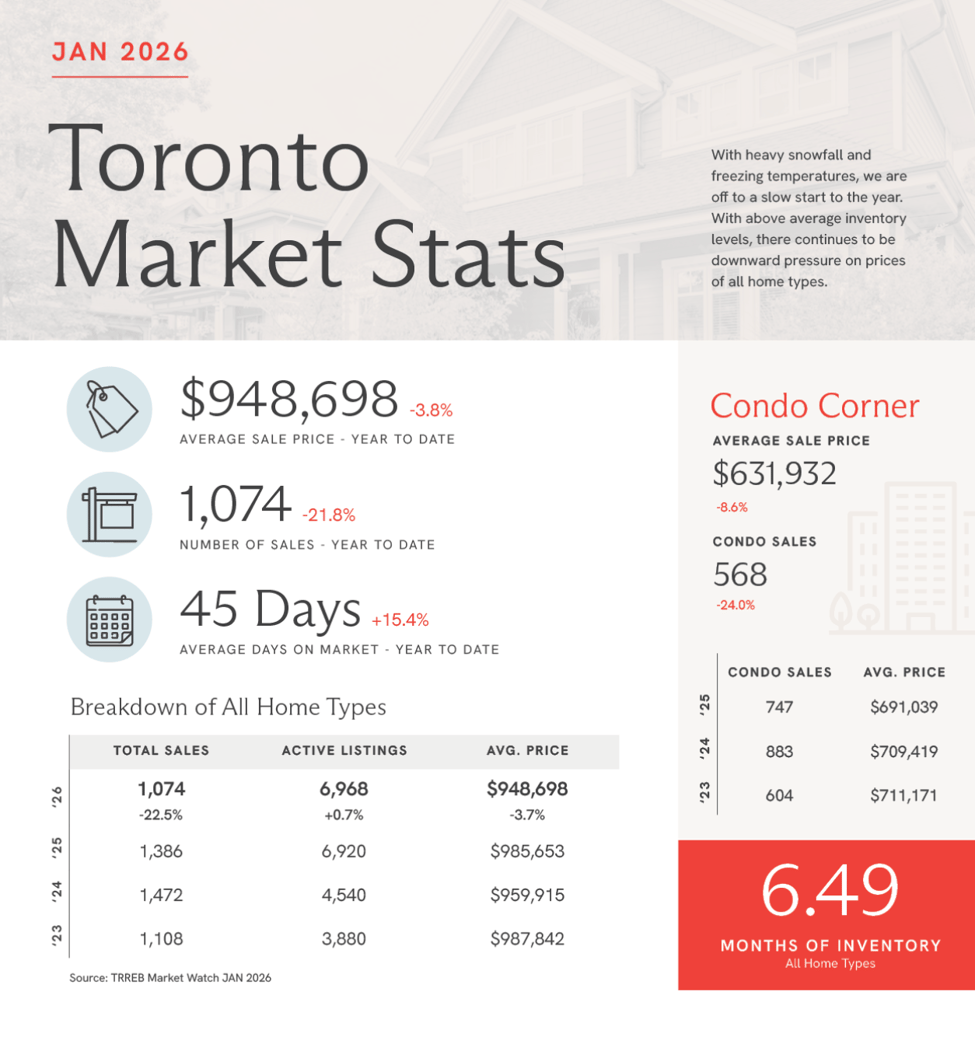

With frigid temperatures and heavy snowfall across the region, the Greater Toronto real estate market kicked off 2026 at a slower pace — which honestly tracks. When it hurts to blink outdoors, fewer people feel like popping into open houses “just for fun.”

But beneath the snowbanks, the market is quietly shifting… and for buyers especially, there are some real opportunities worth paying attention to.

The January Numbers (The Ones You Actually Need)

Sales are down

There were 3,082 home sales reported in January, which is down 19.3% compared to January 2025.

Less activity = fewer bidding wars and more room to negotiate (music to buyers’ ears).

Listings are up

Active listings increased 8.1% year-over-year to 17,975.

More listings means more choice. And more choice means buyers can be pickier, and sellers need to be sharper with pricing and presentation.

Inventory is approaching “buyer-friendly”

Months of inventory across all home types is now 5.8 months.

Quick translation: months of inventory measures how long it would take to sell everything currently listed if no new listings came to market.

Economists generally say that as inventory approaches six months, the market starts to lean buyer-friendly — meaning:

more selection

less urgency

more downward pressure on prices

…and overall improved affordability

In other words: the market is offering buyers a little breathing room right now.

Prices: Down Year-Over-Year

The average selling price was $973,289, a 6.5% decline compared to January 2025.

Now, before anyone panics: Toronto real estate doesn’t move in a straight line. It breathes. It pauses. It adjusts. And right now, the data is showing a market that’s giving buyers a window.

Rates: Holding Steady (For Now)

The Bank of Canada recently announced no change to interest rates, and that matters.

Rate stability combined with slightly lower prices tends to coax buyers back off the sidelines — especially the ones who’ve been watching for the right mix of conditions.

Because let’s be real: buyers don’t just care what a home costs. They care what it costs every month. And that monthly payment is what’s been keeping a lot of people cautious.

What Happens Next: A Likely Busier Second Half of 2026

Jason Mercer, Chief Information Officer of the Toronto Regional Real Estate Board, has noted that current inventory levels should help keep prices in check, but he’s anticipating a busier second half of 2026 as affordability improves and consumer confidence strengthens.

That timing matters.

Because if you’re a buyer, the best opportunities usually show up when:

inventory is higher

competition is lower

sellers are more negotiable

and the general vibe is still “let’s see what happens”

Once confidence returns, demand tends to follow — and when demand picks up in Toronto, pricing usually starts nudging upward again.

If You’re Buying This Year, Here’s the Play

If you’ve been thinking about buying in 2026, this is not the time to wait for the perfect headline or the magic “bottom.”

This is the time to:

watch the market closely

learn what true value looks like (by neighbourhood + property type)

get your financing lined up

and be ready to move when the right home appears

Because when things heat up later in the year, the best listings will move faster, and the negotiating leverage shifts.

Condo Market Update: Still a Bit of a Rollercoaster

The condo market continues to face challenges — and a big driver is new supply.

Approximately 20,000 new condo units are expected by the end of 2026, which is a lot of product coming online.

January condo stats:

Condo sales were down 26% compared to January 2025

Average condo prices declined nearly 10% to $604,759

That average price drop is largely driven by increased sales of smaller, investor-type units. Prices for these smaller units across the GTHA have declined to levels that are starting to look more attractive to investors again.

If you’re a condo owner: strategy matters right now.

If you’re a buyer: selectivity matters even more.

Not all condos are created equal — and today, the “right condo” is about far more than just the price tag.

The Bottom Line

This market is offering something we haven’t seen much of in recent years: choice.

For buyers, that can mean opportunity — if you’re informed and ready.

For sellers, it means the details matter more than ever: pricing, prep, positioning, and a plan.

And if you’re somewhere in the middle (aren’t we all?), I’m always happy to talk through what this means for your specific situation — whether you’re thinking about upsizing, downsizing, investing, or just want a “what’s my home worth right now?” gut check.

If you have real estate questions, send them my way. I’m always here — and I promise to keep it honest, strategic, and as stress-free as possible.